Currently Empty: $0.00

What is cfd trading

Quality research, and integrated trading signals: One of the main reasons Saxo is among my top choices for CFD trading has to do with the quality of its research across such a wide range of tradable CFDs, and integrated trading signals within its platform suite Versus Trade. Saxo’s high quality research and integrated trading signals can make it more efficient to find and act on trading opportunities and to analyze news events in relation to market price movements.

There are two account types – standard and pro. The standard account is free and offers slightly higher spreads, the pro account charges commissions with lower spreads built in. However, XTB has stopped promoting pro accounts, reserving them mostly for legacy clients.

The best CFD platforms provide a secure environment where you can speculate on global financial markets with user-friendly tools and low fees. Choose from our list of top CFD brokers to find the right platform for your needs.

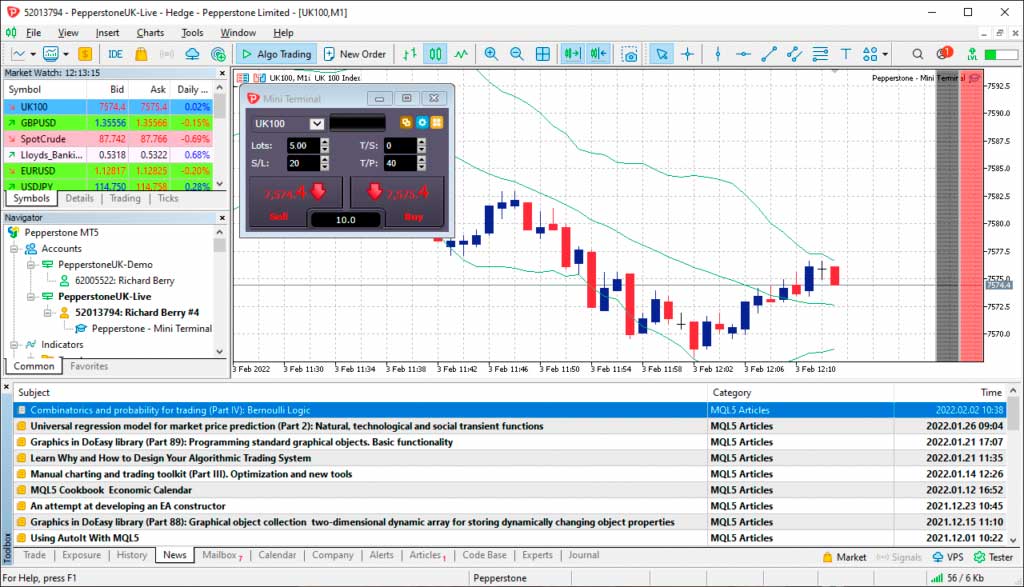

Cfd trading platform

I judged Vantage a well-rounded broker thanks to its high performance in all our review categories. When evaluating the ProTrader by TradingView platform, I was dazzled by its intuitive design and range of powerful features. The popular MetaTrader is also available to clients; an ideal platform for advanced traders and automated strategies.

Interactive Brokers is a highly trusted multi-asset broker with an extensive offering of tradeable global markets. It delivers competitive fees and high-quality research and education, as well as a modern, institutional-grade trading platform suite. Read full review

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site.

I judged Vantage a well-rounded broker thanks to its high performance in all our review categories. When evaluating the ProTrader by TradingView platform, I was dazzled by its intuitive design and range of powerful features. The popular MetaTrader is also available to clients; an ideal platform for advanced traders and automated strategies.

Interactive Brokers is a highly trusted multi-asset broker with an extensive offering of tradeable global markets. It delivers competitive fees and high-quality research and education, as well as a modern, institutional-grade trading platform suite. Read full review

Cfd trading example

Trade the markets with Trade Nation! Trade Nation offer tight spreads on thousands of markets. You can trade on a fast web platform or MT4 or via Trading View! Trade responsibly: Your money is at risk. 81.7% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

Futures contracts have an expiration date at which time there’s an obligation to buy or sell the asset at a preset price. CFDs are different in that there is no expiration date and you never own the underlying asset.

Let’s consider a different example. For example, let’s say Amazon shares are currently trading at 2100 – 2101p in the market, and your CFD broker provides a CFD with the same pricing. If you believe the price will increase, you have the option to purchase a CFD for 10,000 shares at 2101p. The total value of the contract would be £210,100, but you would only need an initial margin of 10%, which amounts to £21,010. If Amazon shares rise to 2140 – 2141p, you can opt to close the CFD position by selling 10,000 Amazon CFDs at 2140p. This results in a gain of 2140p – 2101p = 39p x 10,000 = £3,900, minus commissions.